For instance an expatriate who has gone out of Malaysia to attend meetings was trapped in a foreign country due to travel restrictions. Non-Resident means other than a resident in Malaysia by virtue of section 8 and subsection 61 3 of the ITA.

Jan 2022 Update What To Do If You Get Covid 19 Or Are A Close Contact In Malaysia

Another way to qualify for tax residency is if you spend 90 days or more in the current tax year plus 90 days in three of the past four years.

. How is Tax Residency Defined in Malaysia. The very first requirement to apply for PR status is a person must live in Malaysia for a minimum five consecutive years. The residence status of an individual liable to tax in Malaysia determines whether an individual is taxed as a resident or a non-resident of Malaysia.

That means no more applying for visas and a range of benefits which arent available to expats on short term permits and passes. Residents and non-residents in Malaysia are taxed on employment income accruing in or derived from Malaysia. Even if a person is married to a Malaysian This first rule needs to be crossed out first before proceed on PR status application.

Suppose you are unable to stay in Malaysia for any purpose but your spouse is here behalf of you that can also be counted in your favor during your PR application process. New Eligibility for Malaysia Permanent Resident Status. Income tax in Malaysia is territorial in scope and based on the principle source regardless of the tax residency of the individual in Malaysia.

Criteria for said points as well as additional information for a permanent residency can be found. Being a Malsyian PR is not the same as being a Malaysian citizen however. The resident status of an individual for a basis year for a YA is determined by reference to physical presence of that individual in Malaysia not by his nationality or citizenship.

Generally a company is regarded as resident in Malaysia if at any time during the basis period for a year of assessment at least one meeting of the Board of Directors is held in Malaysia concerning the management and control of the company. The individual is in Malaysia for 182 days or more in a basis year. The Permanent Resident Status is subject to Revocation at any Time if deem Necessary by the Government.

There are 4 sets of circumstances in which an individual can qualify as a resident in Malaysia for the basis year for a YA. Malaysian Permanent Residents are foreigners who have the right to live indefinitely in Malaysia. Foreign-source income is usually not subject to taxation.

The basic distinction in the tax treatment of an individual who is a resident or a non-resident of Malaysia is as follows. An individual is tax resident in Malaysia if he or she stays more than 182 days per year in the country. If you are a foreigner that has stayed and worked in Malaysia for more than 182 days during the calendar year you have a resident status and you will fall under the normal Malaysian tax laws that are also applicable to the native population check out all information on this taxing system in this article.

Determination of Residence Status of Companies. Generally an individual who is in Malaysia for a period or periods amounting to 182 days or more in a calendar year will be regarded as a tax resident. Both tax residents and non-residents are taxed on income derived from Malaysia.

Resident means resident in Malaysia for the basis year for a year of assessment YA by virtue of section 8 and subsection 61 3 of the ITA. An individual who has been in Malaysia for 182 days or more is a Tax resident of the country. 1 For the purposes of this Act an individual is resident in Malaysia for the basis year for a particular year of assessment if a he is in Malaysia in that basis year for a period or periods amounting in all to one hundred and eighty-two days or more.

This prolongs stay period in Malaysia can only be. Tax Residency for the Year of Assessment 2020 Covid-19 and Travel Restrictions The COVID-19 unprecedented event has caused multiple complications in determining the residence status. To be a permanent resident of Malaysia you must be an expatriate in this nation for at least five consecutive years.

Individual Investor with minimum USD 2 million Fixed Deposit FD in Malaysia High Net Worth Individual Having a Fixed Deposit with an amount of minimum USD 2 million in at any Bank in Malaysia and will. Residence status affects the amount of tax paid. In Malaysia in a tax year for 182 days or more In Malaysia for less than 182 days but that period is linked.

Generally an individual will be regarded as a Malaysian tax resident if he she stays in Malaysia for more than 182 days including any temporary period of absence. During this period an Individual is considered to be physically present the whole day even if heshe is present for a few hours. The residence status of subsidiaries of foreign corporations would be determined by paragraphs 81b and 81c of the ITA 1967.

The source of employment income is the. The basic test of tax residency in Malaysia is when you stay longer than 182 days in a calendar year or in a rolling 12 month period. There are 4 ways in which an individual can qualify as a resident in Malaysia - if he falls in any of these categories he will be a resident if not he will be a non-resident.

Within those five years In order for an expat to legally stay in the country. In light of the travel restrictions imposed around the globe for the purposes of determining the tax residence status of an individual the following applies. Resident status is determined by reference to the number of days an individual is present in Malaysia.

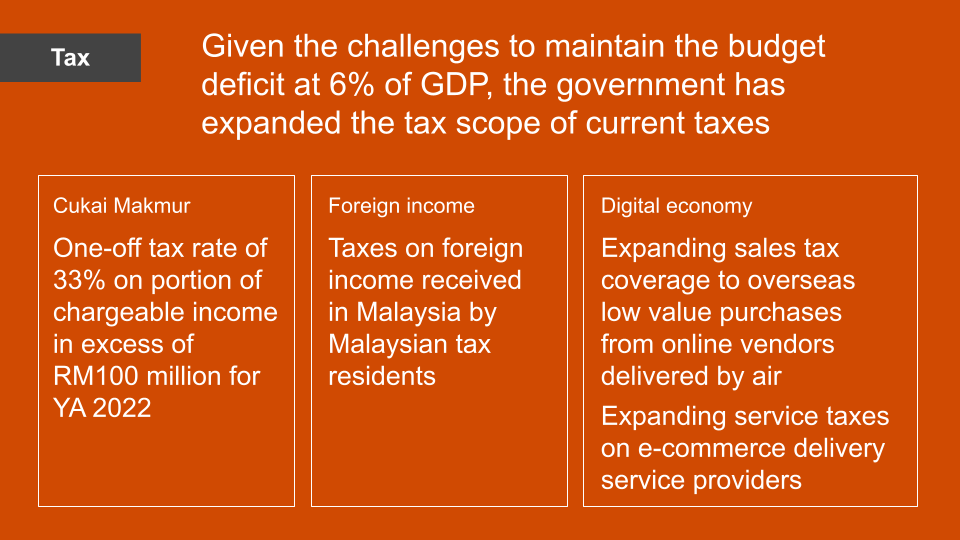

If the days are lesser then they are considered as Non-residents. Personal income tax is levied at progressive rates from 0 to 28 on income exceeding MYR 1000000. Branches of foreign corporations in Malaysia are generally treated as non-residents in Malaysia unless it can be established that the management and control of its affairs or of its businesses or of any one.

It requires an applicant to go through a point-based system and achieve a minimum of 65 points out of a total of 120 in order to be considered. In Malaysia or registering a branch in Malaysia. The last and fifth eligible category is the longest way to obtain a Malaysian permanent resident status.

There are four rules to determine tax resident status of an individual in Malaysia.

Travelling Into Malaysia Mount Kinabalu

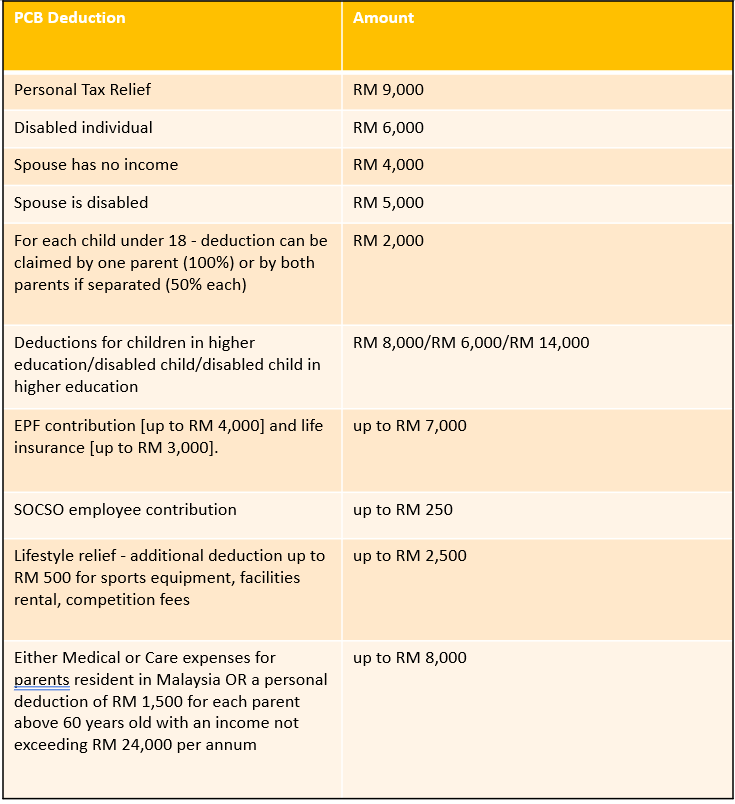

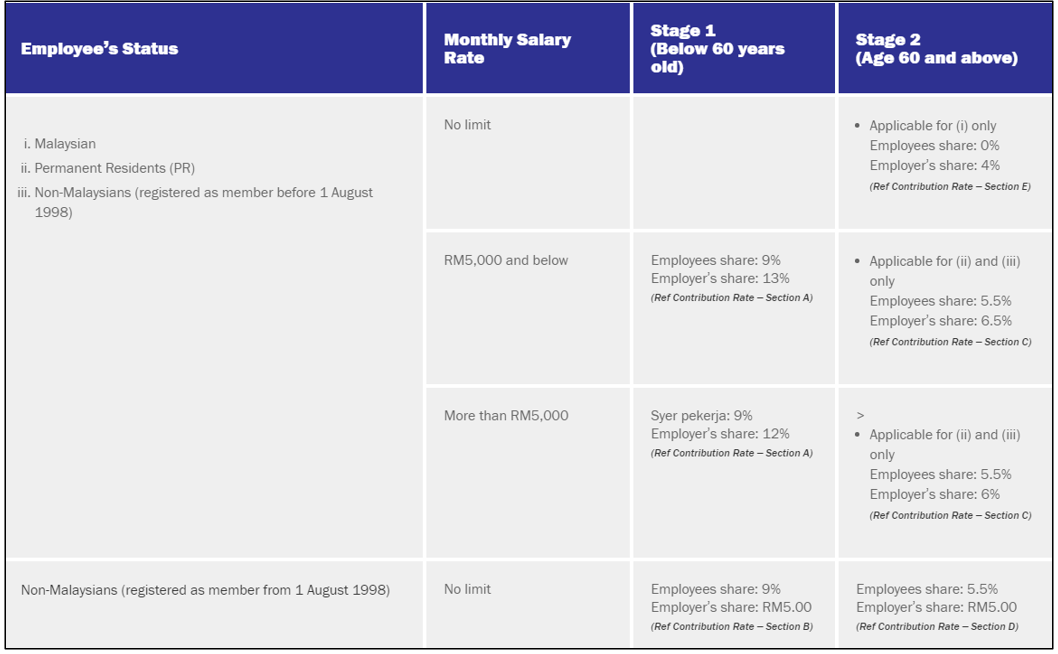

Everything You Need To Know About Running Payroll In Malaysia

Travelling Into Malaysia Mount Kinabalu

Mygov Getting Tourism Information Travel To Malaysia Entry Requirements Into Malaysia Visa Requirement Based On Country

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Procedures For Travellers Entering Malaysia From 1 April 2022 News From Mission Portal

Procedures For Travellers Entering Malaysia From 1 April 2022 News From Mission Portal

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Faqs About Malaysia Singapore Land Borders Vaccinated Travel Effective 1 April 2022

Malaysia To Achieve High Income Status Between 2024 And 2028 But Needs To Improve The Quality Inclusiveness And Sustainability Of Economic Growth To Remain Competitive

Procedures For Travellers Entering Malaysia From 1 April 2022 News From Mission Portal

Procedures For Travellers Entering Malaysia From 1 April 2022 News From Mission Portal

Individual Income Tax In Malaysia For Expatriates

Everything You Need To Know About Running Payroll In Malaysia